Banking, tailored to the user’s lifestyle

Summary

American Express, one of the most valuable and respected brands in the world, is struggling to appeal to the up-coming market due to the change in credit card ownership & their limited product line.

The core driver of this project was to re-capture the brand’s core promise of customer care and satisfaction. With the ever changing demographics and users, it was imperative to understand how the user changed compared to the users before and how it would evolve again.

The final outcome of the project was introducing a internal credit scoring system that adapts and adjusts based on the users financial lifestyle, tailored to include mistakes and calculate risk. This would increased user’s satisfaction and include greater accessibility to users of all income brackets.

All information in this case study is my own & does not reflect the views of American Express.

Published: October 2006

Published: April 2018

The Challenge

The goals of this project was to create a strong foundation that accommodates the users and their changing lifestyles. As the demography changes with new users, who are budget-conscious consumers burdened with debt, how can American Express adapt to this developing market?

Our highest priorities were:

Introducing a fluid system that adapts and evolves with the users

Greater accessibility to users of financial disadvantages

Creating a simple and clear delivery that the customers could understand

Project Planning

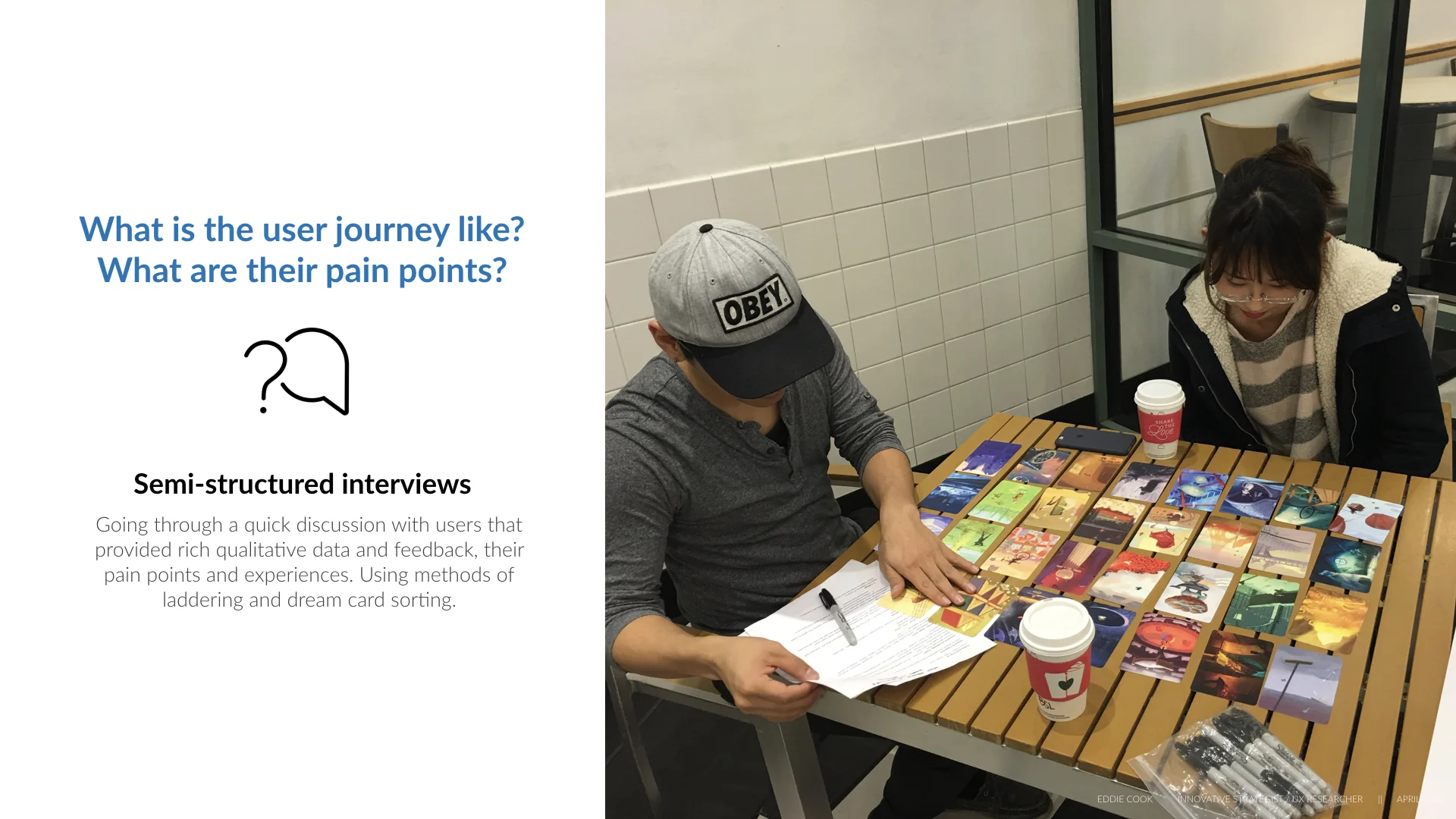

Research Methods Overview :

Discovery Phase

(User journey breakdown)

Prioritizing design goals

Setting keywords based on learnings to set goals that should be addressed

Who are our users?

User Persona

What did we learn + Key insights

The current credit system is unfair and flawed in many ways. It is heavily based on a credit report that is system driven based on strict scoring factors and statistics. A computer looks at data and assigns a number. Everything is either black or white. A person's basic characteristics is not taken into consideration with low tolerance or allowance for the changes in lives and behaviors.

“Simply, it is a failed identity management system.”

Concept Development

INSPIRATION : Everyone is different & have unique situations of their own. Classifying a large group of people to one type of user lifestyle is unfair & is prone to miscalculations and mistakes.

Utilizing a debit/checking system where users can deposit and withdraw from their account.

Users can obtain quick loans from their accounts based on a ratio that is calculated based on their purchasing and spending habits.

Financial Profile

An adaptive rating system that matches the users financial lifestyle

How does this work?

Creating a digital accounting system that adapts and evolves with the users. Based on their patterns & lifestyle, tailored to include mistakes and calculate risk.

A financial profile is created from this pattern & this behavior will allow the AI to predict & rate a financial profile allowing the users to borrow and repay credit within their means.

The User Journey updated

What are the impact for the users

IMPACT FOR USERS : Users would use this system like a debit account with a line of credit that they have access to that adjusts to their lifestyle. Users are able to borrow credit and repay within their financial means.

IMPACT FOR AMEX : Reduced risk of users failing to make payments, higher user retention method, increased product portfolio, higher customer satisfaction.